The boring old SIM card is finally being taken into the 21st century

In the era of globalization, things can be done at the tips of your fingers. Nowadays innovative devices are created to be multi-tasking. For instance, there are more and more features in today’s mobile phones. They are no longer only for phoning, but they are also used for to access the Internet, for gaming and photography. In the same way, SIM cards today are also highly-developed. A SIM (Subscriber Identity Module) card today can also be used in different ways. Let’s look at the the evolution of SIM cards to give us a better understanding.

The Evolution of SIM cards

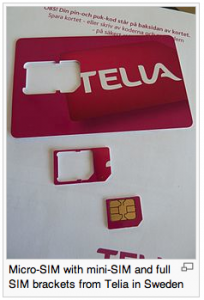

The evolution of SIM cards can be broken down into five periods of time as shown in the Table below. However, the major changes were made from the Full size to Mini sim which still being used today. The current SIM cards that are used worldwide are the second generation. Its size has been reduced by a factor of three since the first generation. SIM cards were first made the same size as a credit card (85.60 mm × 53.98 mm × 0.76 mm). The development of physically-smaller mobile devices prompted the development of a smaller SIM card, the mini-SIM card. Mini-SIM cards have the same thickness as full-size cards, but their length and width are reduced to 25 mm × 15 mm.

The evolution of SIM cards can be broken down into five periods of time as shown in the Table below. However, the major changes were made from the Full size to Mini sim which still being used today. The current SIM cards that are used worldwide are the second generation. Its size has been reduced by a factor of three since the first generation. SIM cards were first made the same size as a credit card (85.60 mm × 53.98 mm × 0.76 mm). The development of physically-smaller mobile devices prompted the development of a smaller SIM card, the mini-SIM card. Mini-SIM cards have the same thickness as full-size cards, but their length and width are reduced to 25 mm × 15 mm.

According to PCWorld, the Nano-SIM will be made the industry standards before the end of 2012 by the European Telecommunications Standards Institute (ETSI). Nano-SIM cards which were designed in conjunction with Apple, are 60% physically smaller than the existing SIM cards. This is also going to be a major development of the SIM card industry in the near future. However, this is not the end of the change yet, as in the future it is said that the physical SIM cards would be replaced by the digital memory of the device. This remains to be seen!

| SIM card | Standard reference | Length (mm) | Width (mm) | Thickness (mm) |

|---|---|---|---|---|

| Full-size | ISO/IEC 7810:2003, ID-1 | 85.60 | 53.98 | 0.76 |

| Mini-SIM | ISO/IEC 7810:2003, ID-000 | 25.00 | 15.00 | 0.76 |

| Micro-SIM | ETSI TS 102 221 V9.0.0, Mini-UICC | 15.00 | 12.00 | 0.76 |

| Nano-SIM | ETSI TS 102 221 V9.0.0, Mini-UICC | 12.00 | 9.00 | 0.76 |

| Embedded-SIM | JEDEC Design Guide 4.8, SON-8 | 6.00 | 5.00 | <1.0 |

Source: http://en.wikipedia.org/wiki/Subscriber_Identity_Module

NFC-Enabled SIM cards

Not only has the physical size of SIM cards changed, but also the technology inside the SIM cards has been developed. The technology that has been talked about most recently is NFC-enabled SIM cards. These come in a form of an existing standard SIM card with an NFC chip which will act like an electronic wallet and will allow the users to scan their mobile devices at the scanning point to pay their bills. For example, NFC (Near Field Communication) chip will allow the users to pay their Metro tickets by just scanning their devicesat the scanner at the gate. It is 4-cm proximity transaction performance when inserted in a non-NFC mobile phone. The aim of NFC is to make the transaction to be fast with not so high value of payment, so that the users will not have to wait in the long line to pay. To compare with Bluetooth, they are quite similar but the differences are that NFC is faster when connecting two devices together. However, NFC is slower when transferring the data with 424 kbit/s while as Bluetooth is at 2.1 Mbit/s in the shorter distance less than 20 CM. This point is considered to be a strength point of NFC because there will be no intervention of the data transferring if there are many devices around there.

What exactly is an ATM SIM CARD?

An ATM SIM card is an another technology inside the SIM card. The ATM (Automated Teller Machine) SIM is a new service that turns a mobile phone into a pocket ATM machine. ATM SIM works like normal SIM cards, but one extra feature called “ATM SIM” has been added. The main tasks of ATM SIM is to make balance inquiries, transfer money, make bill payments, and set payment alerts from a phone, even topping up a user’s mobile account or a friend’s. Except that deposits and withdrawals are not available, (HAPPY, 2012).

Another technical difference is that the memory of an ATM SIM can storage up to 128K, whereas normal SIM cards are between16K and 64K. With such space, normal SIM card can hold cell phone number, rate plan, LAI (Location Area Identity), Service features and preferences, Text messages, Address book (info for about 250 contacts), PIN lock, (Timeatlas, 2012).

Looking at an ATM SIM card, it has an additional menu item, the ATM SIM menu, which allows you to make a variety of banking transactions for your Bank account from your mobile phone. An ATM SIM card can be made the phone call. The size of a SIM is as same as a normal SIM card which is 25 mm × 15 mm. With that size, it can be removable and transferred to different mobile devices as long as there is not yet an evolution of the SIM card. To conclude, an ATM SIM card is basically similar to a normal SIM card. The only differences are that it has an ATM SIM menu and has more memories than the normal SIM card. As a result, the users can simply use the SIM card to make a phone call as well as having an ATM menu on their devices.

Looking at an ATM SIM card, it has an additional menu item, the ATM SIM menu, which allows you to make a variety of banking transactions for your Bank account from your mobile phone. An ATM SIM card can be made the phone call. The size of a SIM is as same as a normal SIM card which is 25 mm × 15 mm. With that size, it can be removable and transferred to different mobile devices as long as there is not yet an evolution of the SIM card. To conclude, an ATM SIM card is basically similar to a normal SIM card. The only differences are that it has an ATM SIM menu and has more memories than the normal SIM card. As a result, the users can simply use the SIM card to make a phone call as well as having an ATM menu on their devices.

You may wonder what a difference between I-banking and ATM SIM. Well, ATM SIM will allow the users to do the banking activities without accessing to the Internet. It relies on the phone operating network, which is elsewhere and free of charge comparing to paying for the Internet package in order to access to the I-net banking. It obviously can be used if there is no Internet access. The user can still do the banking activities as they wish. Therefore, the users can use it wherever they go as long as there is a phone network.

ATM SIMCARD ensures the security of the users by using the 3DES technology. All transactions conducted via ATM SIM are encrypted with 3DES technology, on both outgoing and incoming information from the ATM SIM to the bank, as well as by the bank’s own security system. It is just as safe as making a transaction from an ATM machine. It’s simply to use, just like on the ATM screen. It’s even safer that the user has to put the passward everytime they use.

ATM SIM card has been used widely in Thailand in the past few years since it was introduced to the country. It started with the cooperation between the commercial bank of Thailand, Kasikorn Bank and the mobile phone operator, DTAC (HAPPY). They saw the potentials in the use of ATM SIM which matched with the users need for mobile banking activities. Later on, it has been applied to all three main operators and almost banks in Thailand.

ATM SIM card has been used widely in Thailand in the past few years since it was introduced to the country. It started with the cooperation between the commercial bank of Thailand, Kasikorn Bank and the mobile phone operator, DTAC (HAPPY). They saw the potentials in the use of ATM SIM which matched with the users need for mobile banking activities. Later on, it has been applied to all three main operators and almost banks in Thailand.

Why have ATM SIMCARDs been so popular in Thailand?

Well, it’s all about timing. ATM SIM was introduced to Thailand in the past few years when 3G became an ongoing issue. Thai consumers were unable to use 3G thought out the country. Hence, the Internet package is provided with a high cost. Moreover, the number of the phone users in Thailand has been increasing over time. It has played an important role in everyday life activities.

Even now the 3G networks can only be accessed in certain areas. Therefore, ATM SIMCARD has replaced ATM machines. For those users who want to be connected to the bank at all time without worrying about the Internet network. They choose to have their ATM SIMCARD on their pocket.

Conclusion

Cellular industry is in a rapid growth. Every sector has its own development. Mobile phones has changed from being a black and while screen phone to now with a smart phone. As well as in the SIM card sector, we see how SIM cards physically have been changed from time to time with more and more technology created inside the SIM cards. The change will continue to be. We’ll just keep an eye on the big evolution of the SIM cards!

References:

C-ITV. (2012). NFC on a SIM card gives new life to legacy phones. Retrieved May 21, 2012, from http://contactlessintelligence.com/2012/02/24/nfc-on-a-sim-card-gives-new-life-to-legacy-phones/

HAPPY Happy. (2012). ATM SIM. Retrieved May 18, 2012, from http://www.happy.co.th/index.php?option=com_content&view=article&id=293&Itemid=142&lang=en

Kasikornbank. (2012 b). K-Mobile banking ATM SIM. Retrieved May 19, 2012, from http://www.kasikornbank.com/EN/ServicesChannel/SearchServiceChannel/MobilePhone/Pages/KMOBILEBANKINGATMSIM.aspx

Lee, C. (2011). Downsizing the SIM cards. Retrieve May 21, 2012, from http://blogs.terrapinn.com/cards/2011/11/16/downsizing-sim-cards/

Timeatlas. (2012). SIMCARD. Retrieved May18, 2012, from http://www.timeatlas.com/cell_phones/general/understanding_sim_cards

Walters, R. (2011). NFC-enabled SIM cards to become a worldwide standard. Retrieved May 21, 2012, from http://www.extremetech.com/mobile/105683-nfc-enabled-sim-cards-to-become-a-worldwide-standard

Wikipedia. (2012). Subscribe identity module. Retrieved May 21, from http://en.wikipedia.org/wiki/Subscriber_Identity_Module

5 réponses à “SIM Card Evolution”

Very interesting article about SIM card evolution and how size and technology changed in the SIM card. It is very interseting to know about ATM SIM card and how it is being used in Thailand and we dont have to rely on the internet network in order to do the banking activities.

About the NFC enabled SIM card, it would have been better if you provide more details as you did in the ATM SIM card explaining the scenario in Thai Industry. IN addition, I think security issues associated with new SIM card technology should not be ignored.

I found this article very interesting! When you think about cell phones, you always think about their design, their features and the latest technologies they have incorporated.

But SIM cards are the last thing you think about! So I think that it is very important to have an idea of the development of these cards which are one of the main components of cell phones. And also be aware that SIM cards can have several functions!

The new Sim card standards have just been announced by ETSI

Wow, it came way faster that I have thought. But I think it will still take a while to disappear the existing Simcard.

To Kanchan, NFC in Thailand is currently not so well-known. However, there are news going on about this technology in Thailand. In opinion, it will be more difficult to implement this in Thailand because Thai people prefer carrying real cash rather than cards or something like NFC.